does maine tax your retirement

Up to 4 cash back California. Contributions on which taxes were already paid are not taxed again in retirement.

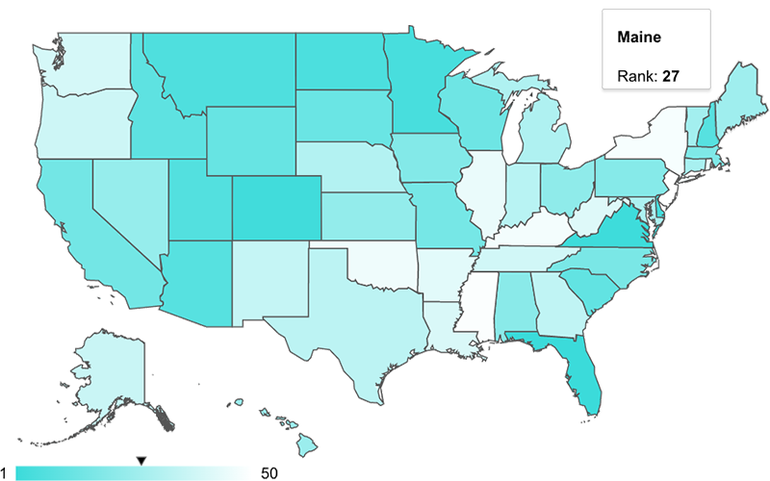

Maine Retirement Taxes And Economic Factors To Consider

In Montana only 4110 of income can be exempt and your adjusted federal gross income must be less than 34260 to even qualify.

. The state of Indiana phased out income taxes on military retirement pay over a four-year period starting with 2019 taxes. For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax. Minnesota 33 of Benefits Missouri Based on Annual Income Amount Montana.

Moving to a low-tax state in retirement can help make your retirement savings last longer. The amount of your MainePERS service retirement benefit is not affected by the amount of your Social Security retirement benefits. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income.

In 2019 25 of the amount above 6250 will be tax-exempt followed by 50 in 2020 75 in 2021 and the full amount in 2022. Retiree already paid Maine state taxes on all of their contributions. First the first 10000 of any retirement income taxed at the federal level will not be taxed within Maine.

How All 50 States Tax Retirees. In addition you and your spouse may each deduct up to 10000 of pension income that is included in federal adjusted gross income. June 6 2019 239 AM.

According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt from the State of Maines income tax. In 2019 25 of the amount above 6250 will be tax-exempt followed by 50 in 2020 75 in 2021 and the full amount in 2022. Retiree paid Federal taxes on contributions made before January 1 1989.

So for example if you receive 12000 in Social Security benefits this year you cannot claim the deduction on your other forms of retirement income. However that deduction is reduced in an amount equal to your annual Social Security benefit. The state does not tax social security income and it also provides a 10000 deduction for retirement income.

While Maine does not tax Social Security income other forms of retirement income are taxed at rates as high as 715. Maine does not tax Social. While Maine does not tax Social Security income other forms of retirement income are taxed at rates as high as 715.

In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a refund of contributions in the prior calendar year. Download a sample explanation Form 1099-R and the information reported on it. Retirement contributions made as an employee make up a portion of the benefits received each month in retirement.

The state does not tax Social Security income and it also provides a 10000 deduction for retirement income. You will have to manually enter this subtraction after creating your Maine return. Over 65 taxable pension and annuity exclusion up to 30600.

In 2018 teachers contributed 765 percent of their salary to the pension fund while the state contributed 1992 percent. Reduced by social security received. Is my retirement income taxable to Maine.

But again there are many states 14 to be exact that do not tax pension income at all. The 10000 must be reduced by all taxable and nontaxable social security and railroad benefits. Connecticut 50 of Benefits Florida no state taxes Kansas.

Benefit Payment and Tax Information. First the first 10000 of any retirement income taxed at the federal level will not be taxed within Maine. Married filers that both receive pension income can exclude up to 20000.

Deduct up to 10000 of pension and annuity income. So you can deduct that amount when calculating what you owe in taxes. The maximum exemption is 2500.

If you are eligible to receive Social Security retirement benefits either because you worked in a Social Security-covered job or because your deceased spouse did the amount of your Social Security benefit may be affected by your receipt of a. New Jersey does not tax military retirement pay. Maine allows for a deduction of up to 10000 per year on pension income.

However your Social Security benefits count toward this amount. To access this entry please go to. Also your retirement distributions will be subject to state income tax.

Enter the pension income deduction from the Worksheet located on Page 18 line 7 from the Maine Individual. The following states are exempt from income taxes on Social Security Benefits. Military retirement pay is exempt from taxes beginning Jan.

Best Worst States To Retire In 2022 Guide

Map Here Are The Best And Worst U S States For Retirement In 2020

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

States With The Highest And Lowest Property Taxes Property Tax Tax States

States That Don T Tax Retirement Income Personal Capital

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

2020 S Best States To Retire Home Health Aide Retirement Smart Money

Retiring These States Won T Tax Your Distributions

Saving Outside Of Work Through An Individual Retirement Account Ira Individual Retirement Account Retirement Accounts How To Plan

Maine Among Priciest States To Retire Study Says Mainebiz Biz

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

Maine Retirement Tax Friendliness Smartasset

Maine Retirement Tax Friendliness Smartasset

Wyoming Child Support Computation Form Net Income Calculation Form Child Support Supportive Net Income

7 States That Do Not Tax Retirement Income